How To Help Your Users Checkout Faster Than An Aldi Cashier

Creating an express checkout process can decrease the likelihood of purchase abandonment, and doesn’t have to mean you lose out on customers registering on your website.

Oops! We could not locate your form.

Creating an express checkout process can decrease the likelihood of purchase abandonment, and doesn’t have to mean you lose out on customers registering on your website.

When ordering anything online there are a lot of considerations, judgements and steps to make before handing over your payment details, and simply making a purchase can involve a lot of steps.

Does the website look trustworthy? When will the item arrive? Will the item arrive? Along with lots of other product or service-specific friction points too.

Payment is one of the biggest steps. Without payment, there’s no transaction. Handing over your card details for the purchase is the biggest hurdle.

So if you can make this process faster for your prospective customers, you can reduce the amount of time in which they have in which they may change their minds.

The problem is before they reach the payment area, they are usually presented with an obstacle course of questions and checks. The longer this takes, the less chance that they complete.

This week I was looking at boiler cover on British Gas. I filled my details out on all their forms, placed in all the information requested and was ready to pay. My expectation was that I’d enter my card details or pay using ApplePay, as at the time I was laying in bed doing this on my phone.

When it came to payment, it asked for my bank sort code and account number for direct debit payments.

However, British Gas required me to open my bank app and attempt to copy and paste my bank details across. What I wanted to do was to pay annually with my card, quick and simple, but it wasn’t an option.

In short, this was too challenging for 11 PM and I decided to quit and go to sleep.

Online retailers know that creating too many steps for buyers is a problem. The rise in mobile has seen the introduction of payment platforms like Apple Pay and Google Pay, where with a tap on your phone you can order from a website hassle-free.

Amazon patented a 1 click process back in 1999 which kept other brands from deploying this tactic until after 2017 when the patent expired. Since then many brands have created versions within their payment solutions that enable an express checkout. Some control the entire basket whilst others just handle the payment processing.

Express checkouts work when a user has their payment details, billing information and delivery address already stored with a website or payment provider.

This can happen in 2 different ways:

So to implement it on a website, you need to be able to store payment card details or utilise a payment provider whom users already have their card details stored with.

Many of the websites that provide single click or express checkout options rely on the payment provider to handle the checkout. These do bypass the registration process in most cases.

However, within standard WooCommerce, you have the ability to store payment options after registration. This means that returning customers can use a faster checkout method after their first order.

In the same way that users need to log in to PayPal or Apple Pay, to create the 1 click or express checkout your users will need to have created an account on your website and have stored their payment details.

If your website uses Stripe, then the buyer’s payment details will actually be stored within Stripe and can be reused on the website without them needing to add them again.

So returning customers on the website want to check out faster. Once they are logged in, the website can display Buy Now or Quick Buy buttons, alongside the standard Add To Cart.

*If your products are variable products you may still require the user to select their options before being taken to the basket page. But ultimately with payment and delivery options already stored, they can checkout much faster.

By users registering, you collect their data and order history, and they benefit from the faster checkout solution. It’s a win-win.

If your business is not built for repeat customers, adopting the Stripe route mentioned above might not be ideal for you. The user may be less likely to want to register unless it’s for something like a warranty or an extended guarantee.

This is where Apple Pay, Google Pay and PayPal can provide the perfect solution, as most users will already have their payment details stored with the providers and this starts a separate journey without the need to register.

You may already have come across ShopPay if you’ve purchased online before, this is the payment provider that is used on Shopify websites. WooCommerce has started to roll out its own payment tool called WooPay, although I haven’t seen much documentation surrounding this as of yet.

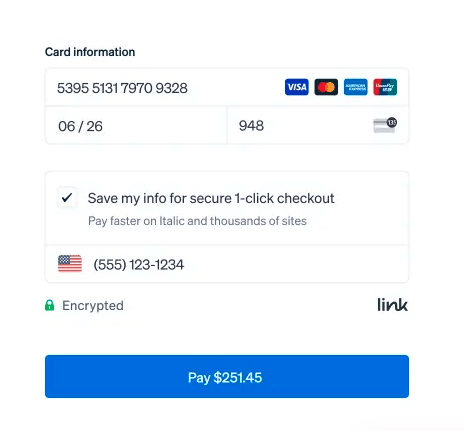

Stripe has taken this a step further and introduced their own version called Link, where any website that uses Stripe to take payments can activate Link. Once a user has stored their payment details in Link, they can check out in just a couple of clicks, across all sites using it.

Just as with Apple Pay, Google Pay, WooPay and ShopPay, on the first experience with Link, a user will need to save their payment details with Link, to ensure it’ll be faster next time. The main upside here though is that there will be far many more websites using Link, so your website may not be the first one they use Link with.

So ensure you showcase the Link logo like you’d display Apple Pay. If they’ve used it before, they’re more likely to use it again, and that’s good for you.

Ultimately, if you’re selling online and not utilising an express checkout solution or storing card details for your customers to make repurchases faster, you are certainly missing a trick.

Begin exploring whether your current payment provider integrates Apple and Google Pay? If it doesn’t, explore integrating Stripe and maybe Link too.

As a fallback don’t forget PayPal, as their checkout works in the same way. There just seem to be far fewer people who are PayPal fans these days, both from the business and consumer sides.

If your business sells products and you want repeat business from returning customers, capture their details and ensure a suitable payment option is integrated into the website, to allow them to checkout faster on their return visit.

If however, your business is all about one-off purchases, then explore checkout options like Apple Pay, Google Pay and Paypal. These will likely work better for your business model.

That’s a wrap for Swipe & Deploy #35. Join me next week when I’ll share another insight or piece of inspiration from around the web.

Whether you are visiting a theme park, zoo or any other type of visitor attraction, there's usually some form of map that customers can download from the attraction's website, that details how they can get around on the day.

James Coates

James Coates

Whether you're in the 'it's ok to put up your decorations in November' camp or strongly feel that 'December is the date for Christmas decorations', your website is another place that can be decorated with festive touches. If you want to start in November, we won't judge!

James Coates

James Coates

For publishers and websites that rely on advertisement money to support their commercial income, browser AdBlockers, privacy specialist browsers and rejecting Cookie Consent issues can cause an absolute nightmare.

James Coates

James Coates